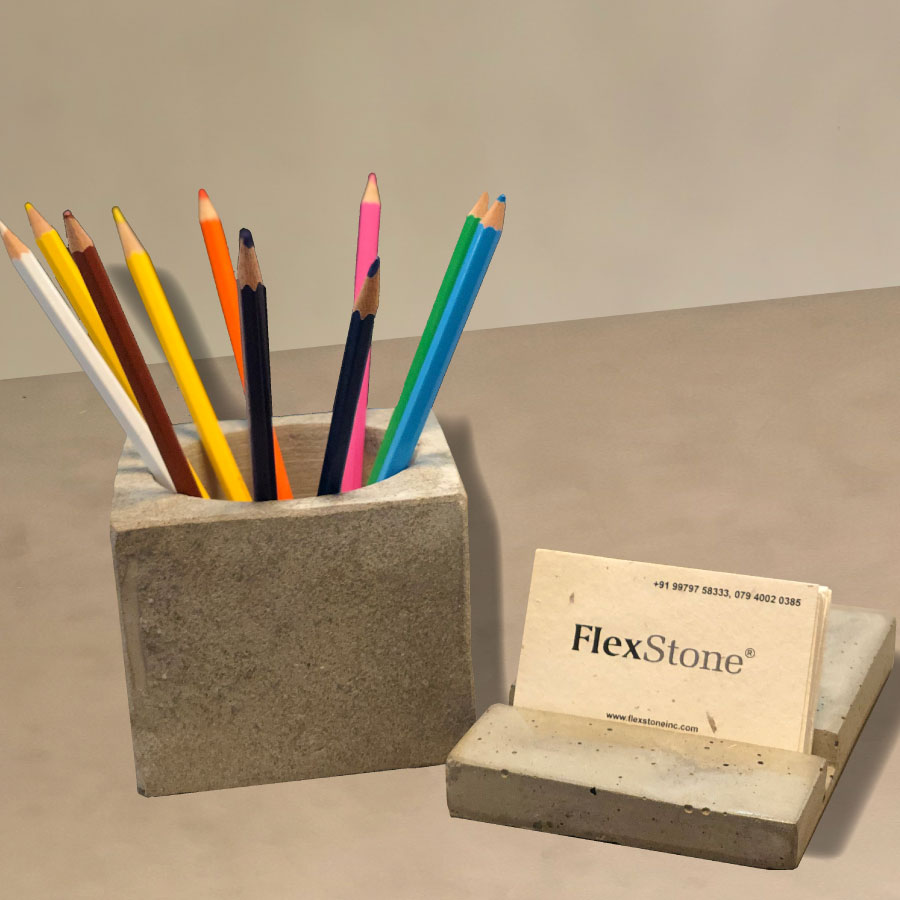

Handmade products with unconventional design processes to give a unique touch to each solution.

A Step-by-Step Guide to Calculating an Asset’s Salvage Value

Calculating after-tax salvage value ensures that all tax liabilities are accounted for, providing a true reflection of the asset’s worth. Peer-to-peer lending offers competitive annual returns from investments in unsecured personal loans. This is why these asset classes were traditionally accessible only to an exclusive base of wealthy individuals and institutional investors buying in at very high minimums — often between $500,000 and $1 million. These people were considered to be more capable of weathering losses of that magnitude, should the investments underperform. However, that meant the potentially exceptional gains these investments presented were also limited to these groups.

Double-Declining Balance Method

Investors use salvage value to determine the fair price of an object, while business owners and tax preparers use it to deduct from their yearly tax liabilities. Depreciation measures an asset’s gradual loss of value over its useful life, measuring how https://x.com/BooksTimeInc much of the asset’s initial value has eroded over time. For tax purposes, depreciation is an important measurement because it is frequently tax-deductible, and major corporations use it to the fullest extent each year when determining tax liability. The residual value of a car is the estimated value of the car at the end of the lease.

Salvage Value vs. Depreciation

The salvage calculator reduces the loss and assists in making a decision before all the useful life of the assist has been passed. The salvage or the residual value is the book value of an asset after all the depreciation has been fully expired. By the end of the PP&E’s useful life, the ending balance should be equal to our $200k assumption – which our PP&E schedule below confirms. The beginning balance of the PP&E is $1 million in Year 1, which is subsequently reduced by $160k each period until the end of Year 5. By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy. We’ll assume the useful life of the car is ten years, at which the car is practically worthless by then, i.e. for the sake of simplicity, we’ll assume https://www.bookstime.com/ the scrap value is zero by the end of its useful life.

- Annual straight line depreciation for the refrigerator is $1,500 ($10,500 depreciable value ÷ seven-year useful life).

- Unlike the other methods, the double-declining balance method doesn’t use salvage value in its calculation.

- Other commonly used names for salvage value are “disposal value,” “residual value,” and “scrap value.” Net salvage value is salvage value minus any removal costs.

- If you do opt to keep your salvage car, the insurance company will calculate the salvage value of your car and reduce any settlement payout by that amount.

- By integrating financial data and automating calculations, Deskera ERP ensures accuracy and consistency in determining salvage values across various asset categories.

How Much Is My Car Worth?

![]()

The residual value is determined by the bank that issues the lease, and it is based on past models and future predictions. Along with interest rate and tax, the residual value is an important factor in determining the car’s monthly lease payments. An estimated salvage value can be determined for any asset that a company will be depreciating on its books over time. Some companies may choose to always depreciate an asset to $0 because its salvage value is so minimal. Salvage value is the monetary value obtained for a fixed or long-term asset at the end of its useful life, minus depreciation. This valuation is determined by many factors, including the asset’s age, condition, rarity, obsolescence, wear and tear, and market demand.

From there, accountants have several options to calculate each year’s depreciation. It includes equal depreciation expenses each year throughout the entire useful life until the entire asset is depreciated to its salvage value. The original price or initial cost of an asset includes its purchase price, installation costs, and any other expenses incurred to bring the asset to a usable state. Any financial projections or returns shown on the website are estimated predictions of performance only, are hypothetical, are not based on actual investment results and are not guarantees of future results. To democratize these opportunities, Yieldstreet has opened a number of carefully curated alternative investment strategies to all investors.

Example of salvage value calculation for a car belonging to a business for after and before tax

A zero salvage value means that at the end of its useful life, the asset is expected to have no resale or trade-in value. It could be due to the asset being entirely worn out, obsolete, or incapable of generating revenue. In this case, the entire cost of the asset can be depreciated over its useful life.

This can lead to a decline in their salvage value as buyers prefer assets with the latest technological capabilities. The demand and supply of salvaged assets can fluctuate, affecting their value. If the market is saturated with similar assets, the salvage value may be lower due to decreased demand. Conversely, if there is high demand for a particular type of asset, the salvage value may increase. Salvage value and depreciation are both accounting concepts that are related to how is salvage value calculated the value of an asset over its useful life.

This is often heavily negotiated because, in industries like manufacturing, the provenance of their assets comprise a major part of their company’s top-line worth. A business owner should ignore salvage value when the business itself has a short life expectancy, the asset will last less than one year, or it will have an expected salvage value of zero. If a business estimates that an asset’s salvage value will be minimal at the end of its life, it can depreciate the asset to $0 with no salvage value.

from our client care experts NOW!

As a general rule, the longer the useful life or lease period of an asset, the lower its residual value. This method assumes that the salvage value is a percentage of the asset’s original cost. To calculate the salvage value using this method, multiply the asset’s original cost by the salvage value percentage. Companies take into consideration the matching principle when making assumptions for asset depreciation and salvage value.